The Mispriced Markets Portfolio

Highlights From The Blog - Latest Portfolio Updates & Reviews

Current Holdings

For more information on these stocks and to stay abreast of changes to the portfolio, check out the blog section of this website.

Full disclosure: The stocks listed below are based on the author's personal holdings.

C.H. Robinson - CHRW.NASDAQ

Logistics

Hibbett Sports - HIBB.NASDAQ

Retail

International Money Express - IMXI.NASDAQ

Financial Services

Kronos Worldwide - KRO.NYSE

Chemicals

Linamar - LNR.TSX

Auto parts

Omnicom Group - OMC.NYSE

Advertising

Signet Jewelers - SIG.NYSE

Retail

Stella-Jones - SJ.TSX

Wood Products

Mispriced Markets In Your Inbox

Want to stay up to date on the latest portfolio updates, reviews, blog posts and mispriced markets news? Subscribe now and get new posts automatically delivered to your inbox. It's free and I promise not to do anything unpleasant with your email address.

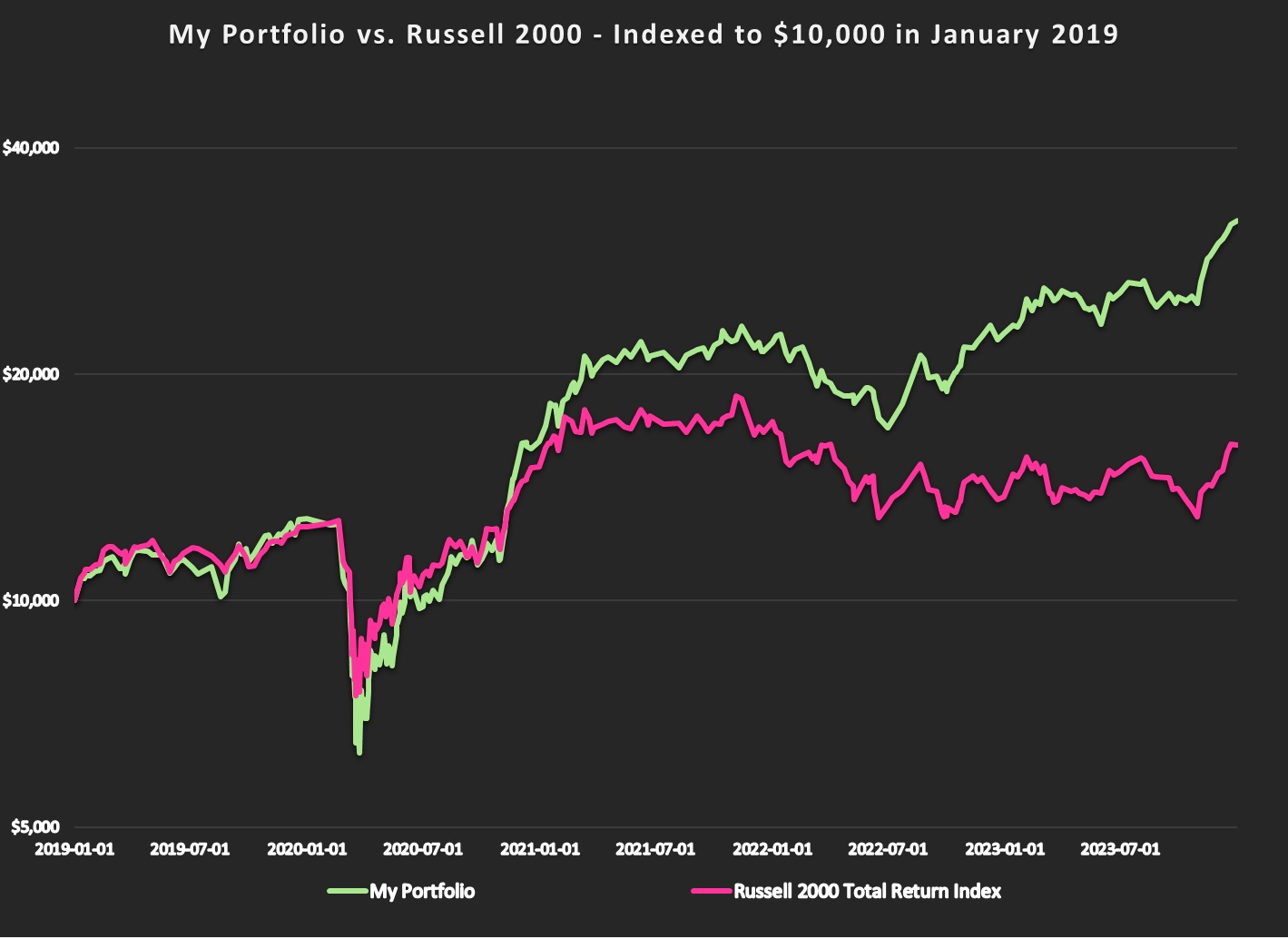

5 Year Performance

My stock portfolio beat the market by 16.5% annually over the 5 year period ended December 31, 2023.

Russell 2000 TR Index: + 10.1% per annum

Mispriced Markets: + 26.6% per annum

See the full 25+ Year Track Record.

Digging through the vaults. An extensive list of the stocks I've owned over the years...

Want to know more about the Mispriced Markets Portfolio? What sort of stocks make it onto the list? How are they chosen? How often is it updated? What's my motivation for publishing it and how can you can use it in your own investing? Hit the button.