As signs of an impending recession accumulate and trade war tariffs loom, the resultant investor gloom is throwing up some very interesting investment opportunities.

Countdown to Recession

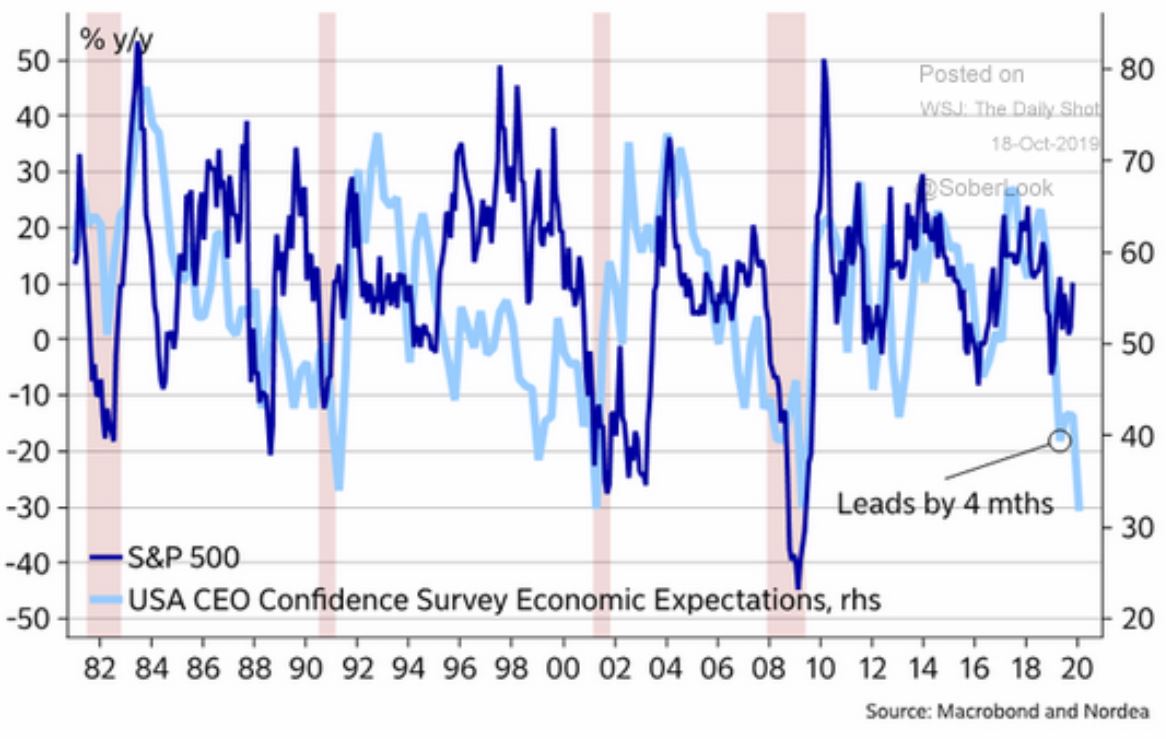

Are we barreling headfirst towards a recession? This is the question that is top of mind for every investor out there right now. CEO’s think we are…

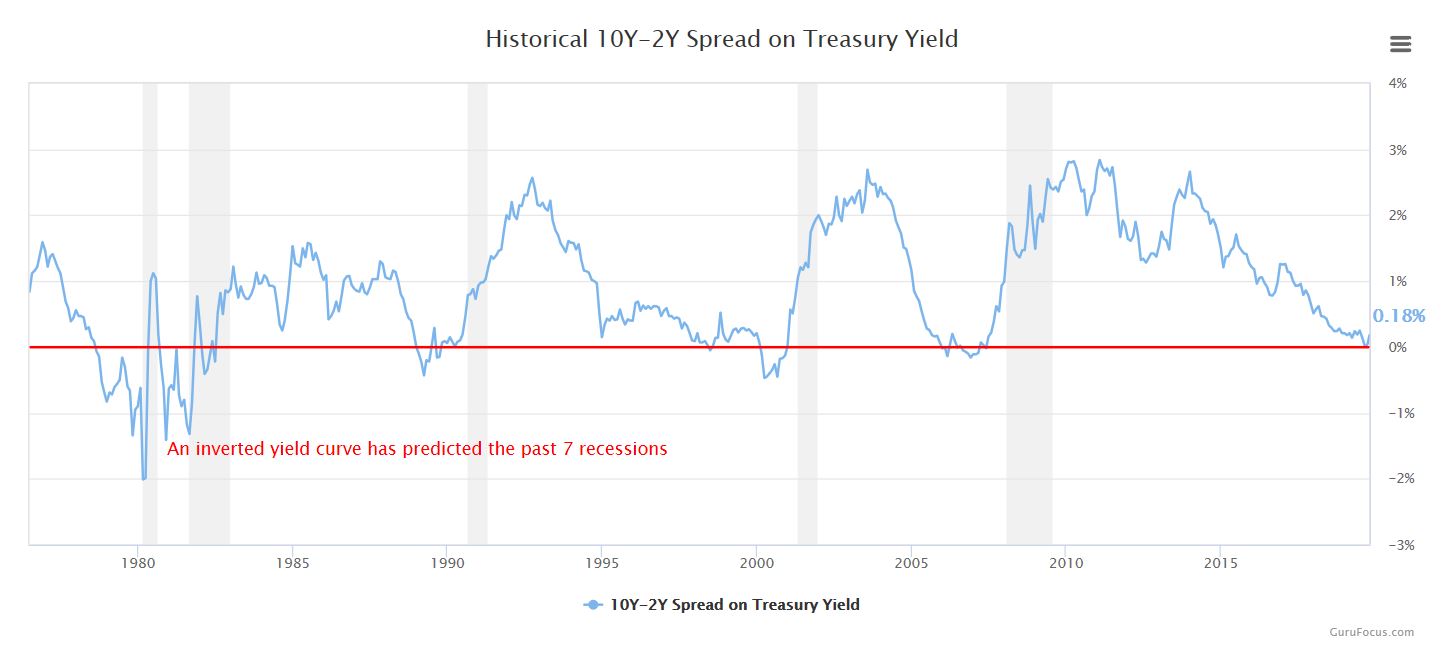

The yield curve says we are…

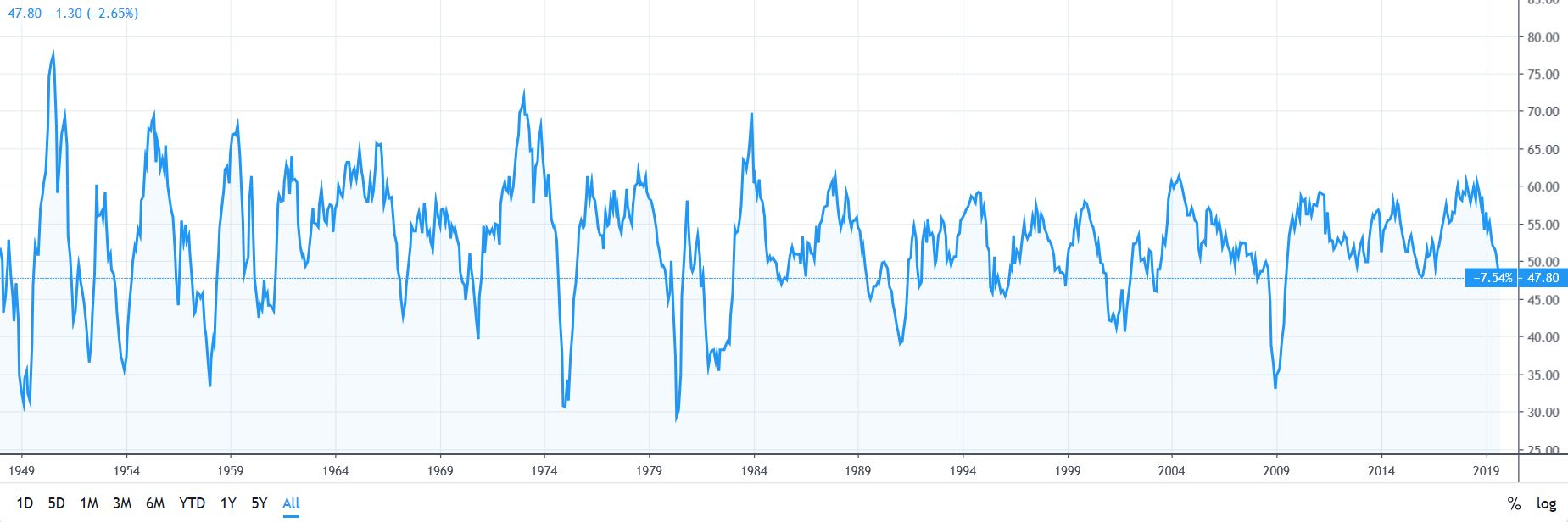

And here’s what the manufacturing purchasing managers’ index has to say…

I could go on, but you get the picture. And so do most investors. Which is precisely why the market has been spinning its wheels for close to 2 years now. The official definition of a recession is two consecutive quarters of negative GDP growth. But it takes awhile for those GDP numbers to come out and they are often heavily revised after the fact as new information becomes available. In some cases, investors don’t get an official confirmation that there has been a recession until after the whole thing is over. By then markets have likely already hit bottom and bounced higher. If you wait until the official word of recession comes down from on high, you will have likely missed all the excitement.

Which is why investors spend so much time obsessing over indicators like the ones above. Everyone wants a glimpse into the future. But recession forecasting is a very inexact science. Despite the accumulating signs that a significant slowdown is underway, it is still quite possible that we will stop just short of recession, as we did in 2012 and again in 2015. Both of those periods saw the economy slow down, catch its breath and then move higher again. Perhaps 2019 will play out the same way. In that scenario, you’d want to be buying up as many beaten down, cyclical companies as you could. Retailers, RV manufacturers, house builders, financials, auto parts, commodities, etc. We could be looking right now at the best potential buying opportunity in several years.

Or perhaps this is more than just a temporary slowdown. Perhaps we will indeed get a recession, but it will be a relatively mild one like we had in the early 2000’s. During the 2000’s the S&P 500 fell like a stone as the big technology and internet companies that had pumped it up imploded, but the companies that lined Main Street fared much better. Many simply saw their stock prices meander sideways for a few years. A similar pattern might play out this time as well as the big tech unicorns get taken down while the old guard soldiers bravely on.

Or maybe the doomsayers are right, and we are in store for another nasty recession like the Great Recession of 2008. CEO’s are certainly getting nervous. Take another look at that graph of CEO expectations. The wide discrepancy between plummeting CEO expectations and a magically levitating stock market suggests that we could be in for a Wile E. Coyote moment as earnings drop and investors look down and realise the ground has disappeared beneath their feet.

So which is it? The best buying opportunity in years, a frightening Wile E. Coyote plunge into the abyss or something in between?

Exciting Opportunities

I wish I knew. It would make my life a lot easier. But I don’t. What I do know is this: For the first time in a long while, I am starting to get excited again about the opportunities I am seeing in the market. As a value investor I am naturally drawn to companies and sectors that have been beaten down or are out of favour. This looming recession, slowdown or what have you, combined with the incessant trade war rhetoric, has been spooking investors and they have been selling off the companies that they think will fare the worst in the coming economic malaise. Cyclically sensitive sectors have been sold off and within those sectors many stocks have seen their prices fall by 50% or more from their highs.

That’s catnip to an investor like me. I entered the summer in defensive mode with more than 30% of my portfolio sitting in cash. But the price of many stocks, especially those in the more cyclically sensitive areas of the market, continued to fall over the summer and this fall I managed to re-deploy a good chunk of that cash into 4 exciting new prospects: Hibbett Sports, Francesca’s, Medifast and Yellow Pages. I’ve still got enough cash in the portfolio to make one more purchase and I’ll be looking hard for a home for this cash in my upcoming third quarter review. My goal is to be fully invested by year’s end and ready to participate fully in whatever the market has in store.

Like many value investors, I often find I get in too early and get out too early. This same pattern may well be playing itself out yet again. I may be turning bullish at precisely the wrong moment. Those CEO’s aren’t stupid. Check out that first chart again. It’s kind of scary.

Looking Across The Valley

But investors are often fighting the last battle. Just because the last recession saw the world’s banking system nearly collapse doesn’t mean the same thing will happen this time. A milder recession like we saw in the early 2000’s would be much more conducive to a fully invested approach, especially if you are buying into profitable companies or companies with a solid history of profitability, at good prices. And there is also certainly the possibility that this will ultimately prove to be a replay of the 2012 and 2015 slowdowns. I make it a point never to ignore what the market is telling me and with the S&P 500 near record highs as I write this, the market is telling me to take a deep breath and calm down. Stuffing the portfolio full of cyclical companies that I can pick up now at deeply discounted prices could turn out to be a brilliant move in hindsight. Or not. Life’s a bitch that way.

At some point in every recession, investors shift their focus. Instead of looking down at the yawning gap in front of them, they start looking across the valley to the other side. Investors are a pretty forward-looking bunch so that point often comes before you’re ready for it. By the time it is clear that the worst of the recession is past (or sometimes before it’s obvious that it’s even begun), stock prices will have already recovered. The trick is to beat the rush. Of course, if you’re in too early, you get caught up in the downdraft. Once again, that bloody market timing thing.

At this point, it is obvious that some sort of slowdown is underway. So I am peering into the distance, trying to see the other side of the valley. I’m looking at companies like Linamar or Cervus or Francesca’s or Hibbett Sports and doing some basic arithmetic. If earnings at these companies were to recover to what they were only a year or two ago then the current stock prices look mouth-wateringly cheap. Of course, earnings may not fully recover. That’s part of the art of the whole thing. But it does get the speculative juices flowing.

The Mispriced Markets Portfolio

As we get ready for third quarter earnings season to kick off, I’m excited by what I hold in the portfolio. It’s a nice mix of turnaround candidates, high growth prospects and simple, value-priced opportunities.

In order to put my comments into context, let me give you the rough valuation framework I am currently using. I would expect the typical small cap company to be trading at a p:e of around 16 right now to its current, trailing earnings. Given this, I’m going to get excited if I can find a company that otherwise passes all my tests for a p:e of 10 or less. Some companies have already seen their earnings start to crumble as the economic slowdown gathers steam, and some have seen them collapse outright. In those cases, I’d expect their shares to trade at a discount to the company’s previous peak earnings. Currently I’m using a “fair value” p:pe guideline of around 11 for these turnaround situations. If I can identify a company like this with a p:e ratio comfortably into the single digits, I’ll definitely take a closer look. On the other end of the spectrum, I’m willing to pay up for high growth. From what I’m seeing, companies that are doubling their earnings every few years are now trading for p:e ratios in the high 20’s. If I can find one I like with a p:e ratio in the teens, I’m going to snap it up.

Please note, any allusion I make below to “earnings” or “p:e” ratios uses my own estimated or calculated earnings which can sometimes be quite different from “as reported” earnings. You’ve heard of GAAP and non-GAAP earnings. These are the Mispriced Markets earnings. They’re my estimate of what earnings would be in an idealized world where everyone pays the same tax rate, no one has to restructure their operations or take a bath on a currency hedge gone wrong or pay pesky lawyers bills for an acquisition they just did. It’s a nice place to live but you won’t find it by plugging the ticker symbol into yahoo finance.

With that said, here is what I currently hold in the Mispriced Markets Portfolio.

Assure Holdings – $1.63

Although I had some misgivings about their accounting, I took the company at its word and bought into this neuromonitoring company 2 years ago at a price of $3.25 per share. Since then it’s been an unmitigated disaster. The CEO was caught using company funds for his personal use and was demoted. The stock was halted from trading for an excruciating 5 months, the company admitted to drastically over-estimating the amount of billed revenue that it could actually collect on and the stock price sank by about 50%.

A new CEO was brought in and so far, he has made all the right moves. He hired new staff to oversee billings and has announced a partnership with an experienced billing agency to bring this crucial function in-house. He took a big bath at the end of last year to write down the uncollected billings and has adopted a new, more stringent standard for booking revenues going forward. Meanwhile, the company continues to expand rapidly into additional territories, winning accolades from the hospitals and surgeons that use their services.

Am I being naïve to still trust the numbers put out by this company, after being burned so badly the first time around? It is difficult to get a clear picture of their accounting because the company is growing so quickly. They are collecting now on revenues that were booked 2 years ago when the company was much smaller, so actual cash flow still seems small in proportion to the level of revenues they are currently booking. Only time will tell if their current collection estimates are valid. Evidently, I am very much on my own here in trusting the current management. Using their reported numbers, I get EPS of 11.5 c CDN in their most recent quarter. Annualising that gives EPS of 46 c for the full year. At the current share price of $1.63, that’s a p:e of 3.6. A 3.6 p:e for a company that grew revenues in their latest quarter at 38% year over year makes no sense. Clearly no one else thinks these earnings are accurate or sustainable.

It’s not the first time I’ve been way out on a limb with my assessment of a company. But the extreme nature of the current price disconnect has even me doubting my position. However, until I see clear evidence that the company is once again mis-stating its revenues, I am choosing to believe in this growth story. If management comes anywhere close to the numbers they’ve been reporting, this stock could be a spectacular performer.

I’d put this one in the high risk, high reward category.

Big Lots – $20.34

Like many retailers, Big Lots has had a tough go of it lately. While it would be easy to blame all their troubles on the faltering retail sector, they are not without blame themselves. They may have under-invested in their brand and after many years of expansion, some of their stores are looking tired and worn. The share price has been steadily declining as comparable store sales disappoint and earnings drift lower. I got into this one too early and have been following its sad, downward progression for the past year.

That being said, its share price decline, combined with some exciting transformation initiatives on the company’s part, have made this quite an attractive holding in my opinion. They have a new CEO at the helm and he is pushing forward aggressively with the roll out of a refurbished and re-energised store format that they are calling their “store of the future”. These new stores are being met with positive reviews from customers and landlords alike and are driving higher traffic volumes. They have had to take on a bit more debt than I like to see to pay for these new stores and will no doubt have to take on more to finish rolling out the new concept to their entire fleet, but their internal rate of return on these new stores is well above their cost of capital so it makes sense to push ahead with this. In fact, the new concept is performing well enough that the company is once again talking about opening new stores after several years of consolidation. They hope to finish the transformation of their store network over the next 2 to 3 years at which point they will have a shiny, new fleet of stores to showcase.

Being a discount retailer, the company hopefully will be somewhat resilient in the event of a recession. At a p:e ratio of only 5.5 to their 2019 EPS guidance of $3.70, and a company-wide transformation initiative that could bear dividends down the road, this stock looks like it could offer plenty of bang for your investment dollar.

Bird Construction – $6.29

Bird construction was a recent addition to the portfolio. The basic premise was that the company has been a solid performer in the past but had been beaten down by a collapse in the resource sector and cost overruns at one of their recent projects. The company has been actively diversifying itself away from the troubled resource sector and will be rid of that pesky contract by next year. They are predicting a return to EPS of 59 c within the year which would put the projected p:e ratio of this stock at a quite reasonable 10.7. A strong balance sheet with cash in the bank and a solid history of paying out most of its earnings in dividends adds some extra juice to the story.

I broke some of my rules when I bought this stock. The company is currently losing money and ordinarily this means I would value it as a turnaround. With a p:e of 10.7 to future projected earnings it should be closer to a sell than a buy. Instead, I’ve been valuing it like those earnings are already in the bag and mentally giving it a fair value of 16 on those projected earnings. The next few quarters will show me whether I have been overly generous in my assessment.

Cervus Equipment – $8.52

Another turnaround situation. This chain of agricultural equipment dealerships was doing well a year and a half ago when I first bought in. Ironically, at the time, I considered one of its chief investment merits to be that it was reasonably non-cyclical and should help to bolster the portfolio in the event of a recession. After all, farming equipment would normally not be considered to be sensitive to the regular economic cycle. Farmers operate on their own schedule, dictated by weather, not by the business cycle.

Sadly, lady luck’s attention was occupied somewhere else and the unexpected detainment of Huawei’s CEO led to a severe retaliation from the Chinese government. They drastically cut their imports of Canadian farm products in retribution. This caused farmers to slam the brakes on their purchases of new equipment and the company’s earnings nosedived. The stock price quickly followed suit.

This stock has now morphed from a stable, defensive play into a turnaround situation. The silver lining in this sorry scenario is that the drop in the share price has now made this quite a compelling story. This seems to me to be a textbook case of an external shock that has temporarily sidelined the stock. For investors who are brave enough to buy in now, after a nearly 50% drop in the share price, at a p:pe (price to peak earnings) of 4.8, that could spell serious opportunity. I don’t know when or if the Chinese embargo will be lifted but I have faith that the farming sector in Western Canada will not disappear. Farmers will find something to plant and someone to buy what they plant, and they will need the machinery to do it. At less than 5 times peak earnings, I’m willing to wait awhile for that to happen.

Essential Energy Services – $0.285

The oil and gas industry in Western Canada is dead. Oil and gas prices are severely depressed and there is no way to get any incremental new production out of the region. The pipelines are full and the prospects for any new pipeline capacity get dimmer by the day. The recent federal election highlighted the profound frustration that voters in the prairie provinces are feeling.

Essential Energy provides drilling services and downhole tool rental in Western Canada. They are managing to scrape by, serving their existing customers and eking out a meagre existence. So why on earth am I holding on to this lame duck story? Because sometimes, the day is darkest before the dawn. Worldwide, oil is selling at below its average marginal cost of production. Capital has fled the sector and that has finally led to some spending discipline. The industry built too many drilling rigs when the oil price was riding high and the sector was booming. It may take a long time to work through this glut but eventually, old rigs will be decommissioned and the over capacity will shrink. Even in the current environment, Essential is pulling in free cash flow thanks to their large non-cash rig depreciation expense. The company has very modest debt levels and is trading at a third of its tangible book value.

Admittedly, this holding feels like a bit of a long shot at the moment. It’s possible that the Canadian oil industry will never recover, especially if the move to electric cars picks up steam. But natural gas could still play a significant role in a cleaner energy future. And if drilling were to ever pick up again, the few remaining service companies that are left standing could see their day rates go through the roof.

I’d definitely put this in the high risk but potentially high reward category.

Francesca’s Holdings – $19.21

This stock has been up and down like a yoyo since I first bought in immediately following their second quarter earnings release. I’ve followed this apparel retailer for a while, watching their painful descent from a rapidly growing, successful retail concept earning over $15 a share to a washed up, has-been, losing money and headed for possible bankruptcy. All this over the span of about 2 years.

While I liked the potential here, I was waiting for some sign that their turnaround efforts might be bearing some fruit before committing my hard-earned capital to this transformation story. Those second quarter results gave me the green light I was looking for. A new CEO is in place and seems to be making some progress in his efforts to turn the company around. Earnings improved when compared to last year and comp store sales aren’t dropping quite as quickly as they were. Franchisees are saying that the company seems to be buying product that customers actually want again.

At the current share price, even after doubling from where I bought in a little over a month ago, the stock is trading at around 1 times their peak earnings of only 2 years ago. It has $4 per share of cash in the bank with no net debt and is sporting a price to book ratio of 0.6. Those are incredibly compelling numbers. The road ahead is not smooth. Bankruptcy is still an option here. Comp store sales fell 5% in the most recent quarter and earnings could easily dip back into the red in coming quarters, especially if Trump’s tariffs go into full effect this fall. A quick return to peak earnings, while possible, seems unlikely. A long, bumpy road back to redemption seems the more likely scenario.

But the potential payoff in this high risk, high reward situation has given me the courage to hop on board for the ride. And so far, the steep ascent in the share price from where I bought in has not been enough to shake me loose.

GoEasy – $59.33

This company has been one of the portfolio’s stronger performers, more than doubling from where I bought it a few years ago. Even so, I am maintaining my position and continue to see strong potential at this sub prime lender. Lending money to poor credit risks is obviously a dangerous game. And the high interest rates that they need to charge to offset that risk lend the stock an undeniably “icky” quality. Perhaps that is why the company is still trading at a p:e ratio of only 11 even after nearly doubling its earnings over the past few years. The company is still in growth mode with aggressive plans to continue to expand its loan book. A recent partnership with Mogo financial, a Canadian fintech company, to provide online lending shows that they are open to new ideas and new ways to disrupt the staid, Canadian financial landscape. Until I see evidence to the contrary, I’m considering this a high growth stock, and therefore one worthy of a significantly higher p:e ratio.

The company claims that they can withstand a recession and the resulting loan defaults that will presumably ensue. They say they studied the credit performance of the sub-prime sector in the last recession and the performance of their own rent to own stores during this time period and are confident that their results will hold up well to the stress of an economic downturn. But they really only got in to the lending game after the last recession was over so their confidence may turn out to be misplaced. We may well get the answer to this question soon enough. If they are right and they can emerge from the other side of a recession relatively unscathed, this could be the green light the stock needs to power higher.

Hibbett Sports – $23.49

I bought in to this chain of sporting apparel and footwear stores a little over a month ago. Already the share price has moved significantly higher. Is it time to think about making a quick exit and pocketing those gains? After all, the tariffs are still a big, dark cloud hanging over the entire retail sector. Combined with every indication that a slowdown and possibly full-blown recession are coming our way, a quick exit now, stage right, seems like it might be justified.

Perhaps, but I don’t like to leave money on the table. To my eye, this stock still might offer significant upside. The company is guiding towards earnings per share of $2.15 to $2.25 for 2020. That would give the stock a p:e of somewhere between 10 and 11 at the current share price. Like many companies in the retail sector, earnings have slipped significantly over the past 2 years. Profit margins were double what they are today a few years ago. With a new acquisition to leverage, encouraging traction in their e-commerce division and a healthy balance sheet that carries no net debt, it seems possible to me that profit margins might recover at least somewhat over the coming years, providing additional fuel to fan the flames.

It’s not all sunshine and roses. The CEO and CFO both abandoned ship recently, usually not a good sign. The company is currently rudderless, looking for a new CEO to replace the old one. Perhaps I will regret my decision not to take my profits and run, but I have decided to stick this one out and see how the story unfolds.

Linamar – $42.65

On the face of it, this looks like an awfully compelling story. One of Canada’s largest manufacturing companies, they make scissor lifts, agricultural machinery and auto parts. They have operations in North America, Europe and Asia. Last year they reported earnings of around $9 per share. That gives this company a p:e of only 4.7. This for a company with a long history of well above average sales and earnings growth. What gives? Well, for starters, the company recently issued a warning advising that conditions were looking somewhat dire. Sales and earnings are likely to be down in all three of their major divisions. Construction equipment vendors are reducing their capex spending plans, which is crimping their sales of scissor lifts. The auto industry is hurting as well and the recent strike at GM hasn’t helped matters any. Finally, the agricultural machinery division which they acquired last year is getting hit hard by the various Chinese embargos and tariffs on NA agricultural produce. No doubt the very heavy rains and early snowstorms that hit American farmers this year aren’t going to help sales much either. In fact, it is looking something like a perfect storm may be about to hit Linamar.

But Linamar has been through tough times before, most notably during the last recession which witnessed the near death experience of the North American auto industry. Personally, I think they’ve got this. I don’t love the debt they took on to buy MacDon, their agricultural equipment division. Given the subsequent woes in this sector, the timing of this acquisition looks extremely unfortunate. I also don’t love the mix of their auto parts business. From what I understand, their focus tends to be on parts used by internal combustion engines. Not exactly the wave of the future. But a p:e of 4.7 papers over a lot of concerns. Linamar had a compellingly low p:e when I first bought it 3 years ago. Since then, the p:e has only gotten lower as the stock price has treaded water while earnings have climbed higher. I’m sticking by this story and am mentally preparing myself to ride out the coming storm.

Magna International – $70.92

The entire auto sector looks like it is on sale right now. Clearly investors are worried that we will have another carmageddon type scenario like the one we saw in the wake of the financial crisis in 2008. The move towards electric cars is also throwing a big dose of uncertainty at the market and markets hate uncertainty.

Personally, I feel these concerns are somewhat overblown. I don’t doubt that the industry will suffer if we have a major recession. As well, electrification and autonomous driving may create more problems than opportunities for some car makers and their suppliers. But I think the very low valuations in this sector already price all of that potentially bad news in and then some. And I think investors may be discounting some of the positives these changes may bring to companies in the sector. Magna has a lot of exposure to some of these new technologies and may be one of the companies where the opportunities outweigh the negatives.

Magna is currently sporting a trailing p:e ratio of 8.7. Debt is less than 2 times earnings and ROE has been well above the 20% mark for 5 years running. Those are great numbers and investors would normally be lining up around the block to buy a stock like this. But this is an auto parts company and investors are avoiding the automotive sector like the plague.

Perhaps they are right and I am not enough of a visionary to see the extent of the transformation that is about to hit the industry. But for now, I am sticking with this manufacturing powerhouse.

Medifast – $105.63

This company launched a new weight loss program 3 years ago and has been growing like a weed ever since. Revenues grew by over 60% year over year in their latest quarter. They have plans to expand into Hong Kong and Asia and continue their expansion in North America. The stock is currently trading at a p:e of around 18 to trailing earnings and while that is significantly higher than any of the other companies in my portfolio, it is on the low side for a bona fide high growth story. Until the Medifast growth engine shows signs of running out of steam or the valuation moves significantly higher, I am tagging along for the ride.

Melcor Developments – $12.35

This real estate developer has been in business for decades and has ridden out many boom and bust cycles in the oil patch. This one is particularly nasty but despite the difficulties facing Western Canadians, Melcor has continued to produce robust profits. The stock currently sports a trailing p:e of 7.3 and a p:b ratio of 0.4. What’s more, they have been profitable every year for the last 18 years (as far back as I looked). I bought this stock 3 years ago and am still waiting for investors to see what I see. At these prices, I will continue to wait. Meanwhile, I will sit back and patiently collect my 4% dividend.

Rocky Mountain Dealerships – $6.88

Between the two of them, Rocky Mountain Dealerships and Cervus Equipment have a virtual lock on the heavy farm equipment sector in Western Canada. If you’re a farmer on the prairies and you need a new tractor or combine, there’s a pretty good chance you’re going to buy it from one of these two. The exact same shitstorm that hit Cervus has hit Rocky Mountain. The Chinese aren’t buying our canola and as a result, farmers slammed the brakes on new equipment purchases. Inventories at the dealerships have backed up and Rocky Mountain and Cervus could both end up losing money this year. It will take a while for this mess to all get sorted out but while it does, we have an opportunity now to pick up a company like Rocky Mountain at 6.5 times last year’s earnings and a 20% discount to their tangible book value. That looks like an attractive price to me and I have no current plans to bail on this company.

The only thing I could see myself doing at some point would be consolidating my ownership in the sector by selling off either Rocky Mountain or Cervus and moving that money into the other one. It would mean one less stock to follow but would give me the same exposure to what I feel at this point is an exciting turnaround story.

Urban Outfitters – $28.79

There’s a lot to like about this apparel retailer. They have three different brands that are each successful in their own right and a total store count of less than 700 stores which would give them plenty of opportunity to keep growing if they wanted to. They have done well with their omnichannel offering and get a significant proportion of their sales from their online presence. Their balance sheet is strong with no net debt. Last year was a banner year for them and in comparison, this year is looking a little weaker. Certainly, with the economic slowdown that is taking shape, I wouldn’t fault them for that. I’m expecting EPS to come in at around $2.20 this year which would give the stock a p:e ratio of 13. Still undervalued in my opinion, although perhaps not as much so as some of the other holdings in this portfolio. But then this is a higher quality name in my estimation than some of the others and probably does deserve a bit of a higher valuation. At this point, I am definitely holding onto this retailer and hoping that they don’t become a casualty of the current trade war. If I had to sell something in the portfolio, I suppose this one might be on my list of candidates simply because the valuation is a bit higher than many of my other companies, but I wouldn’t be happy about it.

Yellow Pages – $9.05

This is the most recent addition to the portfolio. The company has been making heroic efforts to transform itself from an old economy dinosaur into a dynamic internet media and marketing company for the new, digital era. Investors gave up on this company long ago, but it looks to me like they are starting to make some exciting progress in their transformation efforts.

There is lots of upside potential at the current share price. I’m projecting EPS of $2.00 this year which would give the stock a p:e of only 4.5. And I believe that earnings estimate may be understating things. What’s more, if their current efforts gain traction, I could easily see earnings climbing significantly from these low levels.

However, none of this is in the bag. The company is still losing customers at a distressing rate. Perhaps they are simply propping their profits up by slashing their customer acquisition budget. This one has to be watched very closely. High risk. High reward.

Full Disclosure: I own shares in Assure Holdings, Big Lots, Bird Construction, Cervus Equipment, GoEasy, Linamar, Magna International, Melcor Developments, Rocky Mountain Dealerships, Essential Energy Services, Francesca’s, Hibbett Sports, Medifast, Urban Outfitters and Yellow Pages.