Abandoned by investors long ago, Canada’s legacy yellow pages company may be quietly transforming itself into a modern digital media, marketing and e-commerce success story.

Yellow Pages – Y.TSX

October 7, 2019

Share Price: $8.28

Number Of Shares: 28 075 308

Market Cap: $232 million

An Old Dinosaur Reinvents Itself For The Digital Age

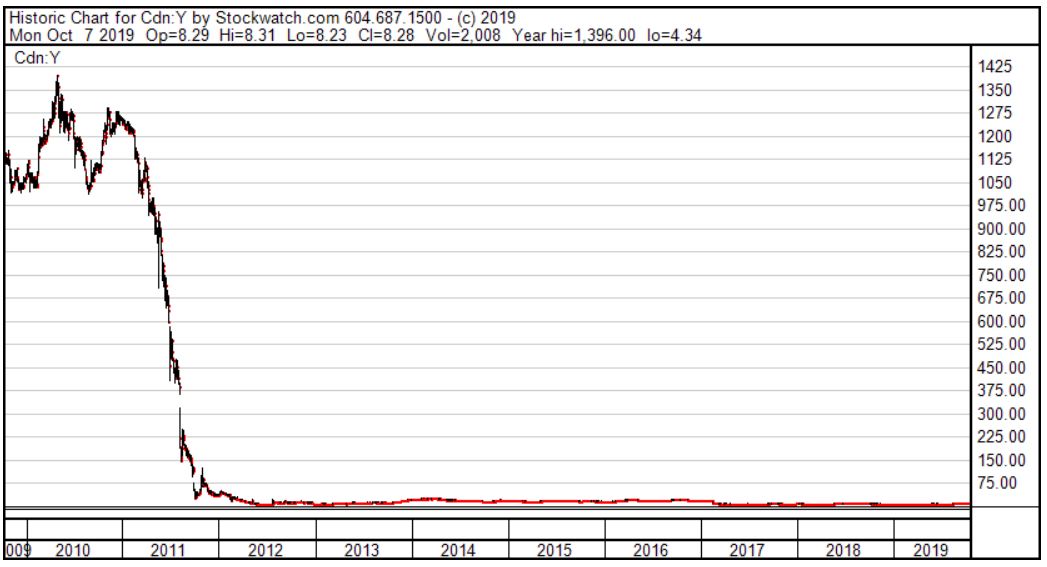

My kids wouldn’t even know what a yellow pages phone directory looked like. Or what the point of it was. Why wouldn’t you just google a company on your phone? What used to be a cash cow with an unassailable monopoly, now looks like an aging dinosaur. Investors bailed on this company long ago and the share price has been scraping the bottom of the barrel for years.

Behind the scenes, though, the story of Yellow Pages’ gradual transformation into a modern digital media and marketing company has been fascinating to observe. The end result is still far from certain but recent results are encouraging. I think there is a decent chance that Yellow Pages, re-invented for the modern internet era will survive and maybe even prosper in the years ahead. I recently added this stock to my own portfolio and have high hopes for this forgotten brand.

Back in the day, this company had a lock on their market. Businesses large and small really had no choice; they had to have a listing in the local yellow pages directory. The internet, of course, changed all that. Yellow pages directories became landfill fodder and this company had to radically transform itself or face certain death. Burdened by a massive debt load, large pension liabilities, an outdated collective agreement, which emphasized seniority over performance, and a core business in terminal decline, the future of this company was bleak indeed.

Against all odds, though, it looks as if there may be some light at the end of the tunnel. After years of effort, the company has gradually transformed itself into a modern digital marketing company. They have aggressively sold off their non-core assets, paid down their crushing debt, re-negotiated their collective bargaining agreement and re-focused their business on the modern, digital era.

Most of their revenue now comes from their online business. They offer a comprehensive suite of online media, marketing and e-commerce solutions to small and mid-sized businesses across Canada. For a fee, they’ll build a website for you, put together a facebook business page and manage it for you, including handling customer queries and posting periodic content to it. They’ll produce a slick-looking marketing video or an eye-catching banner ad. They’ll handle your search engine optimization and google or facebook ad presence. In short, they’ll take care of all the complex online marketing requirements of a modern business and let small business owners focus on what they do best: running their business.

The current CEO took over the reins about a year and a half ago. He sold off a variety of internet properties like redflagdeals.com and duproprio.com that the company had accumulated in its effort to transform itself. He used this money to continue paying down their legacy debt. The company has now paid off virtually all of its bank indebtedness. By the end of the current fiscal year it seems likely that they will have discharged all of their senior debt, which had very restrictive loan covenants attached to it. This will leave the company with only its convertible debenture debt (not due until November 2022) and a legacy pension liability, both of which look quite manageable if the company can maintain its current level of cash flow.

He also recently renegotiated the company’s old collective bargaining agreement and his excitement about this came through loud and clear in the most recent conference call. He says the new agreement removes the shackles from the company and lets him reward strong sales performance with additional compensation and new accounts.

He has been consciously focusing the company on their more profitable customers and letting the less profitable accounts fall by the wayside. As a result, their customer count and overall sales have been dropping over the last number of quarters even as earnings and profit margins improve. Obviously, this is a tricky balancing act and as an outside observer, it is difficult to tell how much of the ongoing decline in sales and customer count is a well thought out, stream-lining of their operations, and how much is a more injurious loss of business to competitors.

Recent sales trends are promising. The rate of decline seems to be slowing. In their Q2 earnings release, they reported, “We are seeing a further strengthening in our bookings which are a leading indicator of future reported revenue”. This company is sitting on a knife-edge here and their future is still up-in-the-air. If it weren’t, investors wouldn’t still be able to buy this company at a bargain-basement price. An investment now, is a gamble that the business is near a crucial inflection point and that, moving forward, the paying down of their bank indebtedness and the lifting of their restrictive loan covenants, the re-negotiation of their collective agreement and the focus on their more profitable, core customer base will pay dividends and set the company up for renewed growth and a more promising future.

Remarkably, through the many years of this company’s transformation, on an adjusted basis, once you ignore the numerous restructuring charges and impairment losses, the company never actually lost money. In their most recent quarter, the company earned about 50 c per share on an adjusted basis. If you could annualise that number (and quarterly results do not appear to be particularly seasonal), you could potentially be looking at EPS of $2.00 per year. At the current $8.28 share price that would represent a p:e of only 4.1. That’s a fairly mouth-wateringly low valuation for what could eventually turn out to be an online media and marketing success story. What’s more, this earnings estimate could even be under-stating things. By the end of the next quarter, they will have substantially paid off all of their senior bank indebtedness and this will cut their financing expenses significantly going forward. As well, they have legacy tangible and intangible assets that they are still amortizing, and this cuts substantially into their stated earnings but is not an actual cash expense.

This is no slam dunk. Like my other recent acquisition, Francesca’s, this is a high risk, high reward type of scenario. Perhaps earnings still look good right now because the company has slashed its marketing and customer acquisition expenses and is simply milking its existing, declining customer base for profits at the expense of its long-term viability. In their latest quarter they lost over 8,000 of their customers. At this rate, they’d lose 32,000 customers a year. With only 170,600 customers at the end of Q2 this is clearly unsustainable. To convince investors that they have a future, the company is going to have to demonstrate that it can stem the tide, retain its existing customer base and start adding new client accounts. By then, though, the stock will no longer be cheap.

I’m not waiting for the signs of a turnaround to become obvious. I’m taking a stake now, hoping that the new CEO’s optimism will prove to be warranted and that this re-invented company will prosper and thrive in the new digital era.

Warning: Trading volume is fairly light for this stock. Larger orders could end up affecting the share price. Be careful if you’re a bigger fish.

Full Disclosure: I own shares in Yellow Pages.