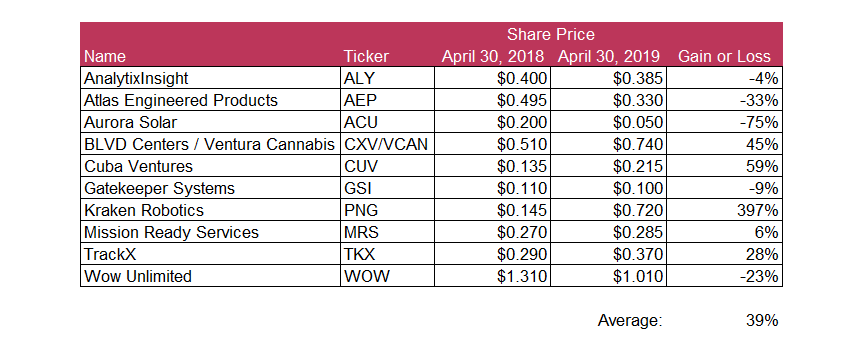

As a whole, the ten micro cap stocks I profiled last year had a great year, rising 39% on average, driven by an impressive 397% gain in Kraken Robotics.

It’s The Bagger Count That Counts

Last year I profiled a group of 10 micro cap stocks that I thought had interesting stories to tell. Most of them had yet to turn a profit but they all had big ideas and grand ambitions. Some I had come across at a micro cap investing conference I attended in Las Vegas. The others had caught my eye during my regular stock screening activities. I dubbed these 10 stocks the “Tiny Ten” and my intention was to follow their evolution over the course of the year to see if any lessons could be learned. I wrote about them in the three blog posts below…

For the most part, they were not the sort of thing I would buy for my own portfolio. They were mostly “story stocks” that had interesting potential and whose market caps did not seem too out of line with the opportunities in front of them. But they didn’t have enough of a history behind them to make their way into my portfolio. Except for one: Atlas Engineered Products was actually making a small profit and I thought their story was quite compelling. I put some money where my mouth was and added this to my portfolio. The other 9 I added to my watch list and followed along with interest as the year played out. Tuesday marked the one year anniversary of the “Tiny Ten” blog post so I thought it would be interesting to check in on this group to see how they performed.

As a group they performed very well, posting an average year over year gain of 39%. $10 000 divided equally between the 10 stocks on April 30 last year would have grown to $13 900 on April 30 of this year. However, the break down of these returns is very instructive and is typical of the micro cap space.

Here are the 10 highlighted stocks with their stock price changes over the past year…

If you had simply divided your money equally between these 10 investments, you would have made out quite well, enjoying a 39% gain on the year. This compares very favourably to the 4.7% return enjoyed by the Russell 2000 Total Return Index and the 2.6% return my own stock portfolio achieved over this same time frame.

However, as is obvious from the chart above, most of this performance came from a single stock, Kraken Robotics, whose share price shot up by 397% over the course of the year. As Peter Lynch would say, this was a 5 bagger. A $10 000 investment in this stock would have grown to nearly $50 000 a year later. You can see why the micro cap sector holds an allure for many small investors!

This sort of performance breakdown is completely typical of this sector and to a large extent, to the small cap sector as well. My father-in-law has a saying, “It’s the bagger count that counts!”. With small and micro cap stocks, I have often found that one or two very strong performers every year help to drive the lion’s share of the portfolio gains for that year. As long as the rest of your portfolio tracks the market, more or less, a couple of big winners can really drive outsized performance. The trick is to set yourself up to experience those occasional big winners while making sure the gains are not offset by a bunch of duds.

I never know before hand which of my stocks the big winners will be. Over the years, I’ve had many multi baggers in the portfolio and these have driven strong returns. But I couldn’t for the life of me tell you at the beginning of the year which of the stocks I held would turn out to be the star performers at year end and which would be the losers. Certainly my pick of the litter in this case, Atlas Engineered Products, was not one of the fortunate ones, posting a loss for the year of 33%. My philosophy is that I stack the odds in my favour by accumulating a portfolio of carefully researched, undervalued opportunities and then I roll the dice. Some will pay off nicely, some will flame out and every so often, I’ll hit pay dirt and enjoy a multi bagger that powers the portfolio higher.

However, in this case, I cannot say that this was a carefully researched collection of undervalued opportunities. It was a collection of interesting stories and I was curious to see how they would pan out but without much in the way of profits or operating history to go on, most of them could not be considered typical value plays. The relatively strong performance of this group over the past year was, to a large extent, simply good luck. I am not about to ditch my current portfolio and plow all of my money into a bunch of speculative, money-losing micro caps. But it is interesting and perhaps informative to see how a diversified group of micro cap stocks performed over the course of a year. Some of my best investments over the years have been in the micro cap space and it is an area that occasionally throws up some real gems.

Kraken Robotics – PNG

Lets’ start our investigation with Kraken Robotics since this was far and away the star of the show. This company specialises in underwater robotics. A sexy story if there ever was one. They had signed up a bunch of new business last year and were launching new products into the marketplace. The potential was there but would they deliver on it? The market cap was $16 million at the time which did not seem excessive but also wasn’t a screaming bargain. The company only had total annual sales of a little over $2 million so to justify that kind of market cap, sales would have to grow significantly.

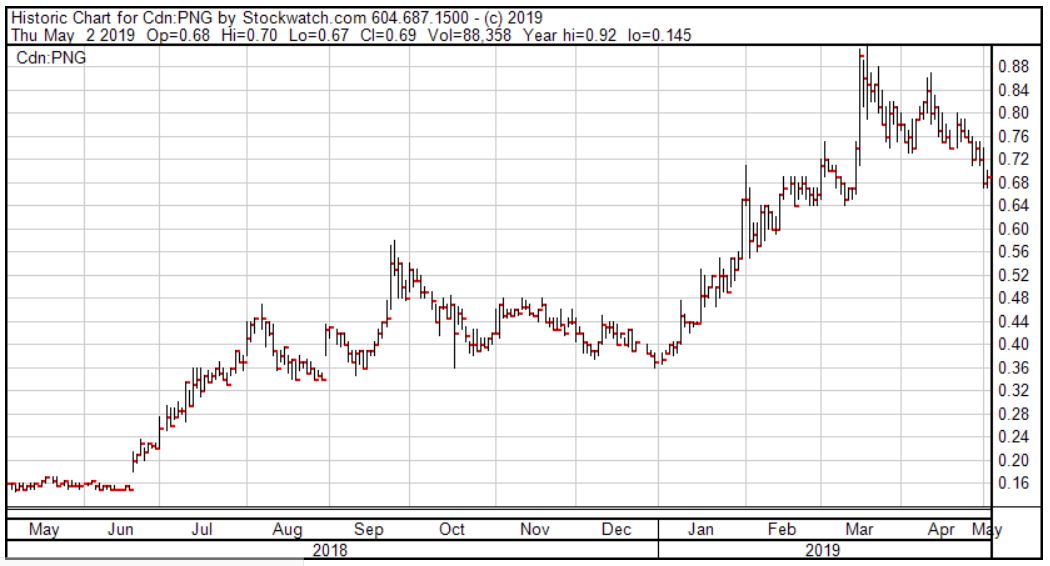

So what happened? Here is the 1 year chart…

The ball really got rolling in June when the company announced that another company, Ocean Infinity, was taking a 10% stake in the company. Ocean infinity is involved in ocean exploration and seabed mapping and their investment and strategic alliance with Kraken was likely viewed favourably by the market as a vote of confidence. Kraken followed this up, shortly thereafter with a press release saying they were on track to record revenues of $7 million for 2018, a tripling over the previous year’s sales. What’s more, they alluded to some additional large contracts that they were pursuing. This kept the stock powering higher into the summer.

For awhile, the stock price drifted sideways as it absorbed these positive developments. In November, they reported their Q3 results and trailing 12 month sales had now grown to $5.5 million, double last year’s annual figure. They reported that they had received a $2.5 million order for deep sea batteries from Ocean Infinity with an expected follow-on order of $6.5 million still to come. They demonstrated their advanced seabed mapping technology to the US Navy. They also announced that they will be submitting a $30 million, multi-year proposal to the government for seabed mapping. Their backlog was up to $13 million, most of which they expected to deliver on in the coming year.

All of this got investors drooling and when risk appetite returned to the markets in January of this year, the stock price took another leg higher. In March, the company announced that they were part of a contract to supply underwater drones to the Belgian Navy. If all aspects of the contract are executed, Kraken’s take could be north of $35 million. The company also announced that they had formed another strategic alliance with a company called “Baltic Diver” to provide advanced subsea 3-D digital inspection technology.

The future certainly looks bright for this up and coming technology play. The market has reacted with great enthusiasm and one can certainly see why investors are excited. However, the company has yet to make a profit. They have issued additional shares to fund their expansion and now sport a market cap of just over $100 million. Is this too far, too fast? This is still very much of an evolving, early stage story. The future could be very bright for Kraken but actual results may well not meet investors’ high expectations. Personally, I continue to sit on the sidelines and watch as this story develops. I suspect the share price has run away from me and the stock will continue to trade at loftier valuations than I am comfortable with. It would be unusual to pick up a sexy story like this at a bargain price, but you never know. If profitability continues to be elusive and sales growth fails to quite live up to what has been promised then perhaps the stock will offer us value investors a better entry point down the road.

BLVD Centers / Ventura Cannabis And Wellness Corporation – VCAN

Moving on to the next two strong performers, it is no great surprise to see that they are in the bitcoin and cannabis sectors. I often have trouble finding any value investments in the sectors that are part of the latest Wall Street investment craze. One way I occasionally get to play these sectors, though, is with a backdoor type of entry into the sector; a company whose core business may be in another field but which has some sort of exposure to the investing fad of the day.

Such was the rationale behind my addition of BLVD Centers and Cuba Ventures to the Tiny Ten list. BLVD Centers operated a chain of addiction treatment centers in the US. They had had trouble achieving consistent profitability and had been experimenting with different business models. They seemed hopeful that a new strategy aimed at devolving management duties onto local clinic owners would help cut costs and improve profits. With a market cap that came in at only half of their annual net sales, this looked like something worth keeping an eye on.

The icing on the cake was a recent plan to introduce marijuana “lifestyle management” to their suite of services. They wanted to offer high quality strains of weed and ancillary remedies to help reduce some of the unpleasant side effects of regular marijuana use. Perhaps this could help them cash in on the marijuana craze. If not as much in a dollars and cents way, then possibly in an investor enthusiasm sort of way.

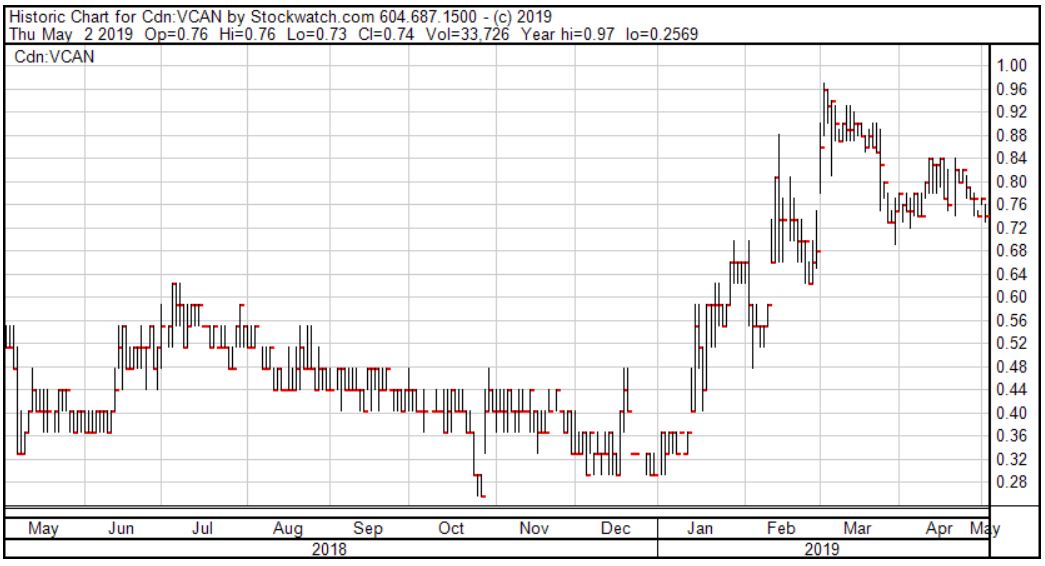

For most of the year, their share price languished below its April 30th value. They continued to explore possibilities in the cannabis sector, looking at studies examining the use of marijuana to control opioid addiction. In their year end results, released in June of last year, they talked about the possibility of making an acquisition in the marijuana sector or of being acquired.

In October they doubled down on their marijuana strategy. In what looks like a reverse takeover, they acquired a marijuana company with $2 million in annual sales but more importantly, a network of connections and possible acquisition targets in the industry. BLVD’s existing CEO retired and stepped aside to make way for the CEO of this newly acquired company. The new CEO was keen to implement the idea of using marijuana for the treatment of opioid addiction and was planning on selling off several of BLVD’s treatment centers that did not mesh with this new marijuana strategy.

In January they announced the acquisition of their first cannabis dispensary and the stock price took off. They followed this up with the announcement of a second pot dispensary and gave up on their addiction treatment centers. They have put these up for sale and plan to use the proceeds from this sale to further their aspirations to grow as an integrated pot company.

The company changed its name to Ventura Cannabis and Wellness Corporation and changed its ticker symbol to VCAN. In the process, they consolidated their shares, exchanging 1 new share for every 7.34 old shares. On a post consolidation basis, their share price rose from 51 c a year ago to 74 c currently, for a gain of 45% on the year.

With the successful sale of their remaining addiction treatment centers, the company could have a war chest of $10 million or more to fund its expansion and acquisition plans in the cannabis sector. They are targeting California as their target market. Assuming a successful sale of their remaining addiction centers, the company will have completed its transformation into a pure play cannabis company in the US market.

Clearly the market is more jazzed about the potential of selling weed than it was about treating drug addiction and the stock price has responded favourably to the change in focus. With a current market cap of around $25 million, you aren’t paying through the nose for this entry into the cannabis sector. Before the sale of their addiction centers, they had $8 million in cash. They had a deal to sell off their non-core addiction units for an additional $5.5 million in cash. It is unknown what they will be able to get for their remining centers, but it will be worth following their cash balance closely. If they can raise a significant amount of cash to fund their aspirations for a marijuana empire with then this stock could have more fire left in its belly.

I’ve avoided the cannabis sector up to now but perhaps this stock will at some point give me a back door way to get in on the action.

Cuba Ventures – CUV

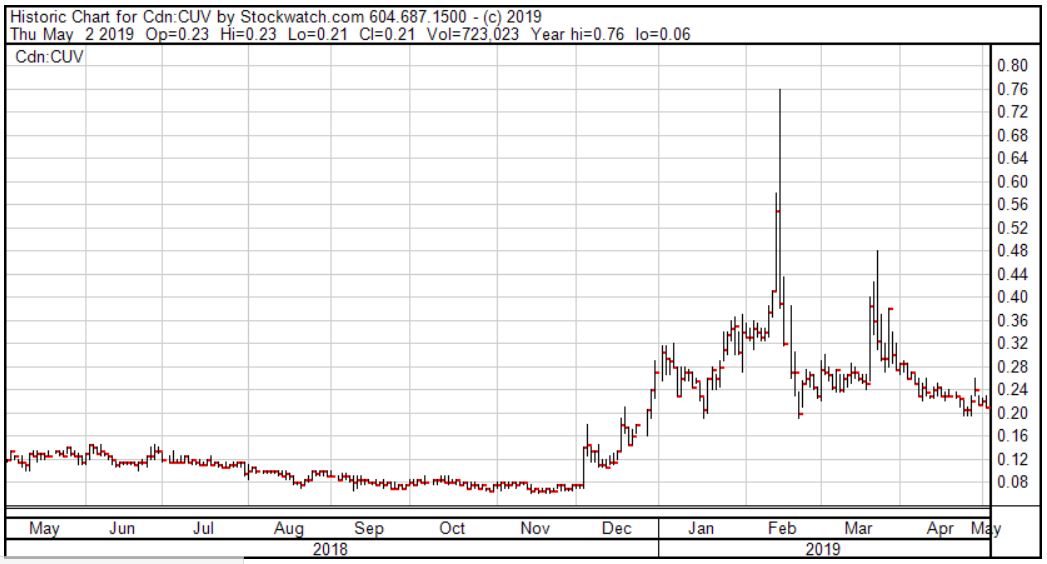

Cuba Ventures was another big winner for the Tiny Ten portfolio with a 59% gain on the year. This was an obscure Cuban travel company that had grander aspirations. They had plans to start up a commercial lending venture in Cuba to target the commercial tourism industry there and had lined up a wealthy Arab investor to fund the venture. But their more audacious idea was to develop their own “Cuba Coin” cryptocurrency. They had made deals with a crypto miner in the Caribbean and had partnered with a European app developer to develop a crypto-based payment application.

In April of last year, cryptomania was in full force and this obscure play on the sector looked like it might have possibilities. With a market cap of only $20 million, it made it onto the Tiny Ten list. From 14.5 c in April of last year, the stock went on to spike up to the 40 c level on two different occasions this winter. It is currently hovering around the 21 c mark.

While the company has pumped out a steady stream of promising sounding news releases touting its core “Revolupay” payment processing app and ancillary products, their many impressive initiatives have yet to show up on the company’s financial statements where total revenues for the latest 3 month period added up to a mere $172 000. The company talks a very good game, but is there any meat in the sandwich? I will keep following this story as it develops but I’d like to see some actual dollars and cents start to appear.

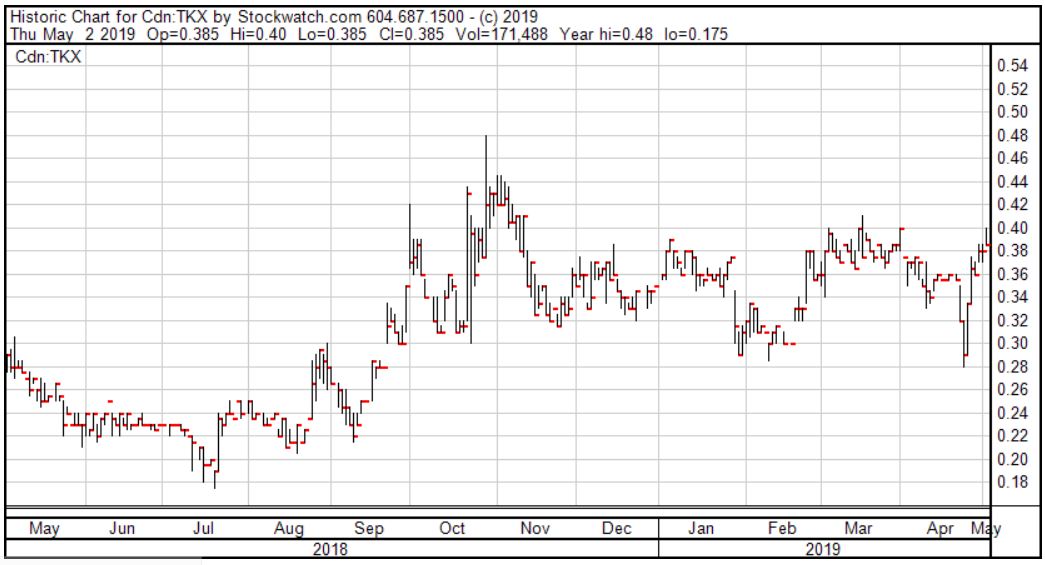

TrackX – TKX

Rounding out the field of gainers on the year, were TrackX and Mission Ready Solutions. TrackX offers an asset tracking suite of software for monitoring a company’s physical assets using RFID tags. The company has announced a string of new contract awards, most recently with the Port Of Oakland but so far these have failed to translate into much in the way of revenue or earnings growth. In the year ended Dec 31, 2018, the company managed to lose $3.5 million on $5.7 million in revenue. The market seems to approve, but these kinds of numbers don’t exactly get my juices flowing. I’d continue to watch for signs of accelerating sales growth.

Mission Ready Solutions – MRS

Mission Ready Shareholders have had a harrowing ride over the past year as the stock was halted for 7 months amidst issues surrounding a proposed acquisition. At the same time, their sweetheart deal to sell $50 million worth of military equipment never materialised. Despite these issues, the stock of this protective wear company ended the year up modestly from where it began, largely on the basis of a significant transformational acquisition of another military equipment supplier. The acquired company enjoyed around $24 million in revenue and $1 million in net income in the 6 months preceding the acquisition announcement. A quick back of the napkin doubling of these numbers gives a potential $48 million in annual revenue and $2 million profit once the acquisition shows up on Mission Ready’s books. Against a market cap of around $43 million, these numbers don’t look too bad. However, I always like to wait to see the actual numbers on the income statement whenever a company does a major acquisition before I make a final assessment. Once the audited financials of the combined entity appear, I’ll be taking a closer look.

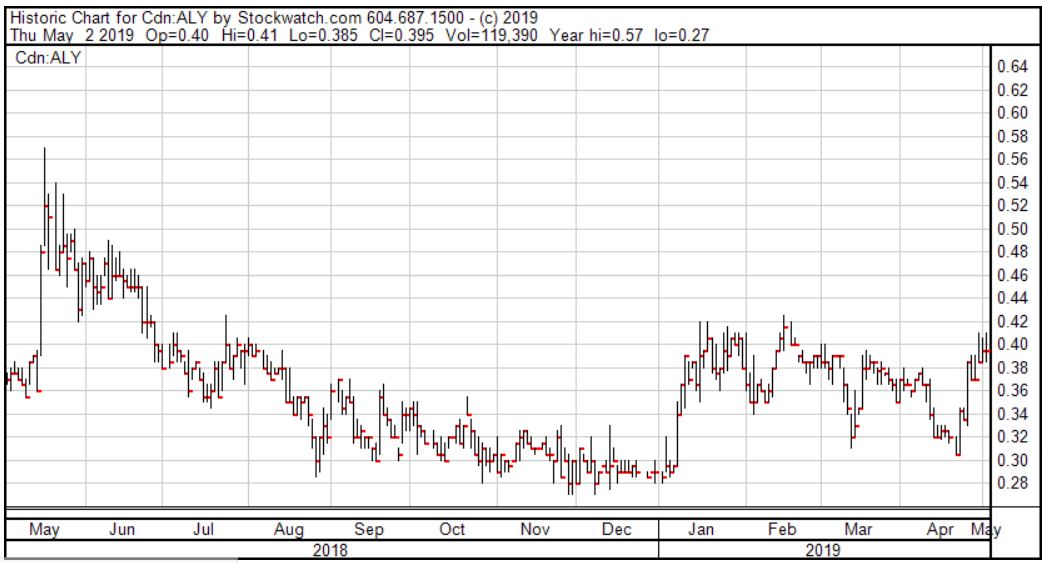

AnalytixInsight – ALY

AnalytixInsight offers an interesting automated stock analysis solution which uses computers to scan a database of over 50 000 companies worldwide to generate analytic reports in plain English. The stock price has drifted sideways as the company failed to show any appreciable sales growth. What’s more, the company continues to lose money. They don’t seem to have found the winning formula that will move their operations into high gear yet.

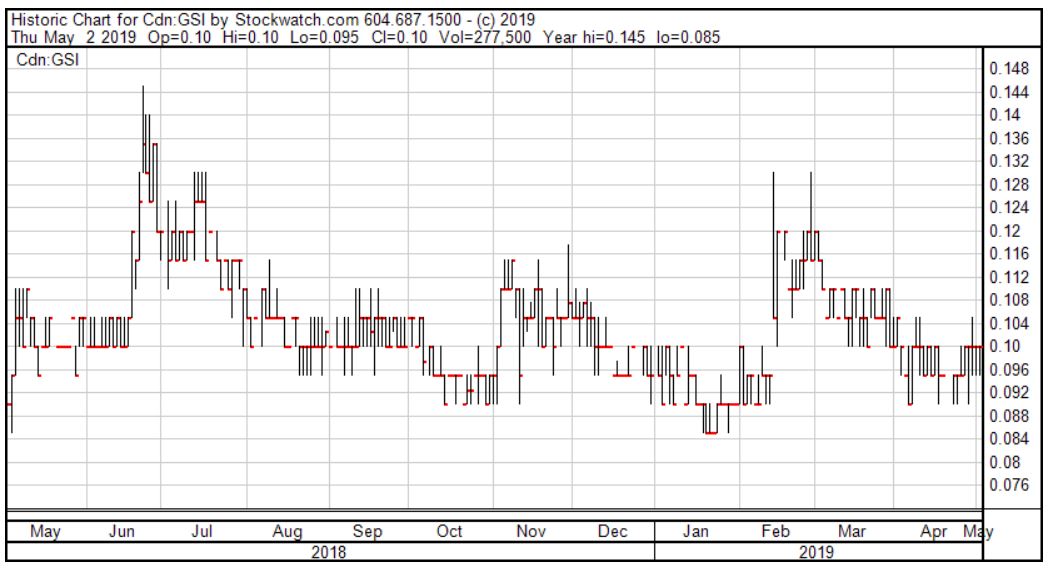

Gatekeeper Systems – GSI

Gatekeeper Systems seemed to offer an interesting play on the surveillance camera industry. Sales have been growing and they have been announcing new contract wins, but profitability remains elusive and the market remains uninterested. A positive number on the bottom line would certainly get people’s attention but in the latest quarter the company reported a loss of half a million dollars on sales of $2.7 million.

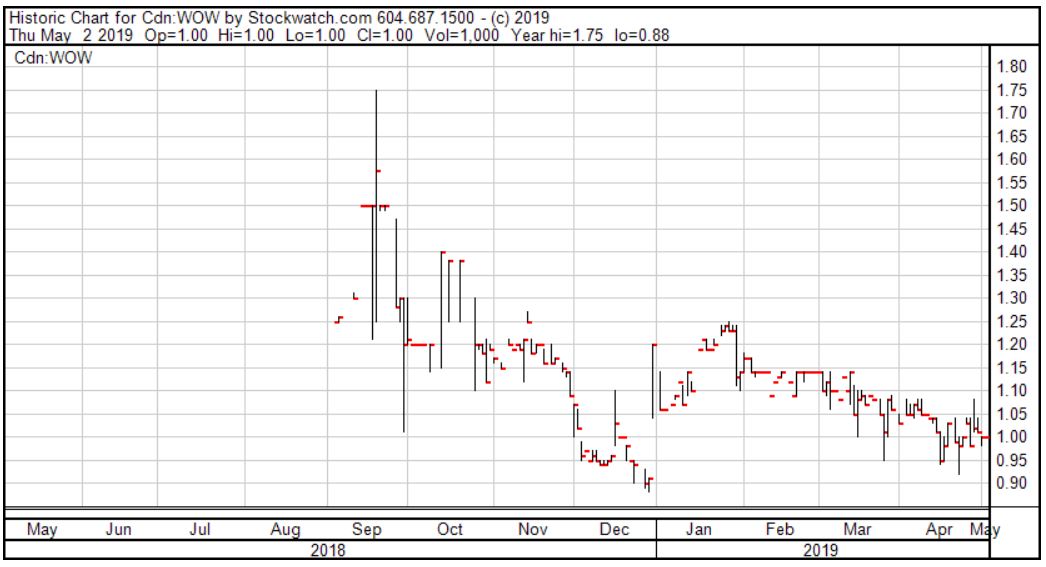

Wow Unlimited – WOW

Wow Unlimited produces kids’ programming which it sells through a variety of platforms including Netflix and its own network of youtube channels. Revenues grew impressively in 2018, increasing from $44 million to $78 million and are forecast to grow another 40 – 45% in 2019. Unfortunately, profits did not follow suit and the company reported an after tax loss of $6.7 million. Still, with strong revenue growth and a market cap that has drifted below $30 million, this stock offers an intriguing play on the evolution of TV entertainment. Without a more robust bottom line, I will continue to watch from the sidelines but with such strong sales growth, a break out to profitability is a definite possibility worth watching for.

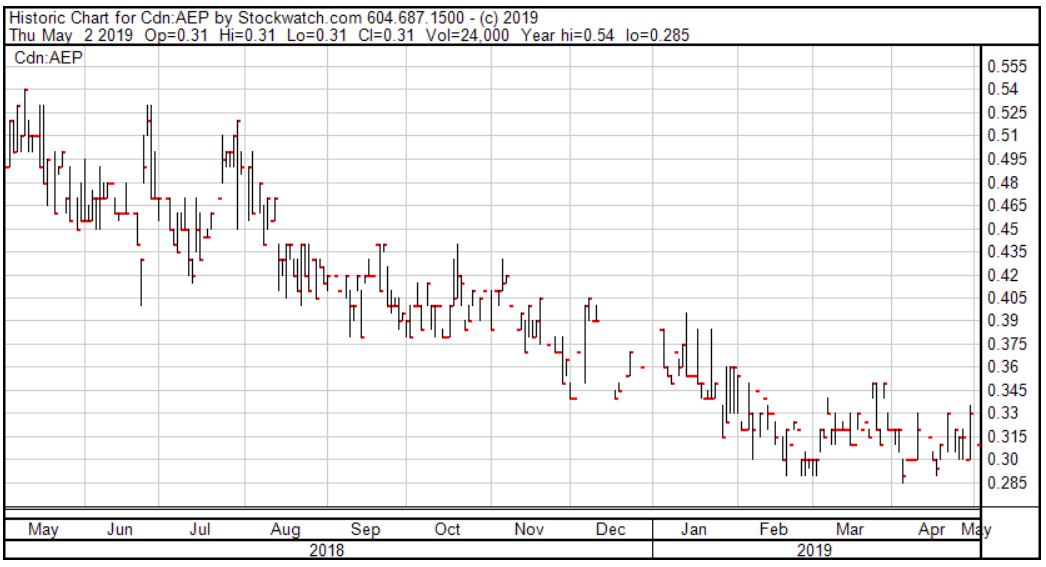

Atlas Engineered Products – AEP

Atlas Engineered Products was the second worst performing stock on this list. I say that with some chagrin since this is the one I was most keen on a year ago and actually bought some for my own portfolio. I still love their idea of rolling up the building truss market and they have been busily working towards this goal, finalising a slew of acquisitions since going public a little over a year ago. While their expansion plans sound promising, the deal making and additional staff needed to oversee their expansion have weighed on profits and the company slipped into loss making territory during the year. That, combined with mounting debt from their acquisition spree, prompted me to exit this investment at a small loss last fall. It is certainly possible that this company’s results will take a turn for the better as their acquisitions are given a chance to bear fruit. But until I see some progress on the bottom line and on the balance sheet, I will watch developments from afar.

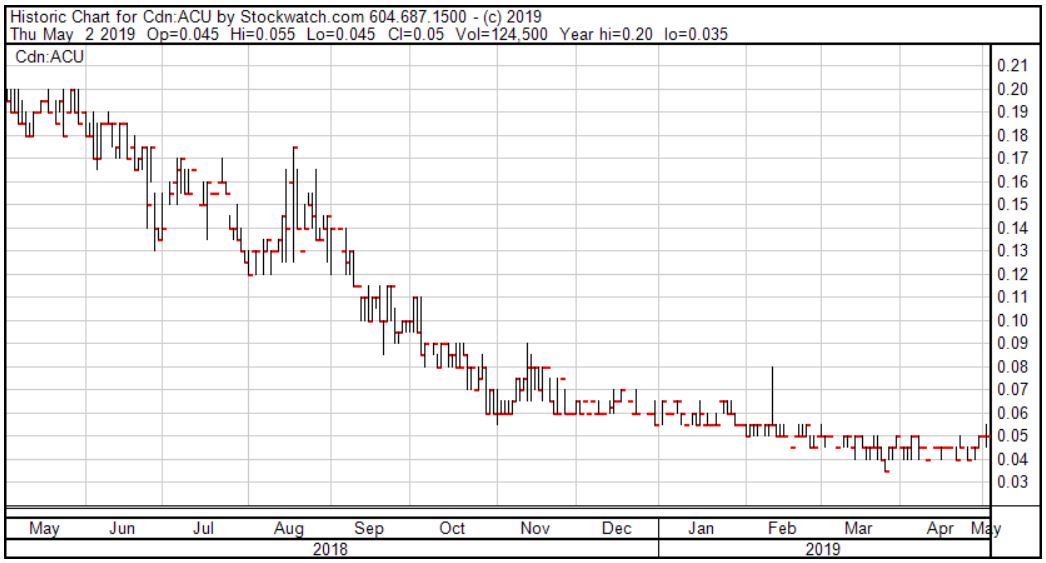

Aurora Solar

Finally we have the biggest loser on the list, Aurora Solar. On paper, this looked like one of the most promising candidates. They have a proprietary technology which uses infrared light to detect defects in solar cells as they move along the assembly line instead of waiting until the manufacturing process is completed to test and scrap the duds. The company was anticipating that sales would skyrocket from the existing $2.8 million mark to over $30 million by 2020. What’s more, they projected profits of $10 million by then as well.

Unfortunately, before they could make any appreciable sales of this wonder system, they ran out of money. In order to raise an additional $1.5 million in cash to fund ongoing operations they had to issue a whopping 35 million additional shares at 5 c each, dramatically diluting existing shareholders. This, combined with a lack of any significant sales, sunk the share price. In the most recent 3 month period, they reported zero sales revenue and a $613 109 loss. Subsequently, though, they announced the sale of 9 of their units to a Chinese solar panel manufacturer. Will this be enough to keep the lights on at Aurora for a little while longer? Hopefully. Perhaps they will ultimately deliver on the mountain of sales and profits they projected last year but the future looks highly uncertain at the present moment.

Conclusions

So what, if anything can I take away from this excursion into the weird and wonderful world of money-losing micro cap stocks? While there were a number of disappointments, there were also a few solid winners and one runaway success story. Overall, this group performed remarkably well in the face of a difficult year in the markets. While this corner of the market can deal out some nasty surprises, if you take a diversified approach to micro cap investing and don’t put all your eggs in the latest investing fad of the day, it’s not quite as scary as it looks on the surface. While I generally avoid companies with no history of profitability behind them, you can sometimes find some very enticing early stage plays in the micro cap sector that have just tipped over into profitability. None of the names on the list above qualify just yet but there are some intriguing names like Kraken, Wow Unlimited, Mission Ready, Ventura Cannabis and Atlas Engineered Products that bear watching.

Maybe I’ll call this the “Promising Five” and check in again this time next year.

Full Disclosure: I do not own shares in any of the stocks mentioned above.