An in-depth look at why this rapidly expanding alternative lender is a bargain at the current price.

GoEasy – GSY

February 26, 2018

Share price: $38.26

Number of shares: 13 476 000

Market Cap: $516 million

The Backstory

GoEasy started out life as a chain of rent-to-own outlets, leasing furniture, electronics and appliances to their customers who might not have had the wherewithal to make an outright purchase or might have just wanted the flexibility of a short term rental. They did a steady business and performed reasonably well through the recession of 2008, remaining profitable throughout. However, in the aftermath of the recession, their expansion opportunities seemed limited in what was admittedly a niche market.

Fortunately, through their interactions with their client base, they recognized what looked like an unmet need. In the wake of the great financial crisis of 2008, new banking legislation resulted in tighter lending standards and the banks pulled back from offering some of the smaller, riskier loans that they had traditionally made. As a result, GoEasy’s customers were reporting that it was more difficult to get the personal and business loans they needed.

The CEO, David Ingram, who has been with the company since 2001, shepherding its growth and evolution the whole way, saw an opportunity to step into the hole the big banks had left behind and began aggressively building out GoEasy’s consumer and small business lending division under the Easy Financial brand. They opened their first standalone Easy Financial outlet in 2011 and have been on a tear since, aggressively expanding this side of their business.

They have been targeting what they see as the sweet spot in between the payday loan stores and the traditional banks. Their loans are typically in the $500 to $25 000 range and are made for terms of anywhere between 9 and 60 months. They are installment loans which are paid off gradually, like a mortgage or auto loan, over the full term of the loan. Their customers generally have poor credit ratings and as a result have been turned down by the traditional lenders.

Easy Financial’s mission is to improve the credit rating of its customers and “graduate” them back to prime lending status. Through its extensive 10 year history of offering sub-prime loans, with over $2 billion in loans being underwritten over this time frame, GoEasy has built a comprehensive database of consumer statistics and subsequent loan repayment performance. It has used this data to produce a proprietary, comprehensive credit ranking system that it thinks gives it a significant competitive advantage over its rivals who typically use more generic credit scoring systems.

Targeting the riskier end of the credit spectrum as it does, GoEasy naturally has to write off a significant portion of the loans it makes. As a result, it also charges significantly higher interest rates to its customers, more along the lines of the rate they might pay on a credit card. However, GoEasy’s rates are still far below those charged by the payday lending sector and so offer consumers an attractive alternative.

GoEasy’s credit risk assessment and loan discipline are crucial to its success. The company follows a conservative approach to accounting for delinquent loans, writing them off after 90 days of late payment. Through its increasing scale and disciplined risk management, the company has been able to secure funding for its loan book at attractive terms relative to many of its smaller competitors. They just recently finalized a new funding arrangement with a series of domestic and international banks, locking in a 7.9% interest rate for the next 5 years. The note offering was well received and they are confidant that they can continue to obtain the financing capital needed to grow their business.

The company has had a very impressive 5 year run, growing from their first standalone Easy Financial outlet in 2011 to a nationwide chain of retail branches by the end of 2017. Their loan book has grown from $32 million to $517 million over the past 5 years. In 2013, they launched their online portal, allowing customers the convenience of applying for their loan online and now, 41% of loan applications are made through this route. They also launched a point of sale product within the last few years which enables customers with weaker credit ratings to apply for financing on their retail purchases at the site of the purchase and this route now accounts for 29% of overall loan applications. They believe that the synergy between these different modes of access is central to their success. Their growing retail store network provides a valuable touchstone even for consumers who obtain their initial loan through one of these remote channels. The customers are directed to the nearest retail branch for ongoing servicing of the loan and the customer loyalty and connections that are fostered through this physical interaction have proven invaluable in improving loan repayment rates and selling additional ancillary loan products.

The company has lofty ambitions for continued growth. In 2011, they opened their first outlets in the province of Quebec where they see the opportunity to significantly expand their network. Late in the year, they also launched their first secured lending product, backed by the customer’s real estate assets which allows them to offer lower loan rates with less delinquency risk. Their goal is to double the size of their loan book from the current $500 million level to $1 billion within 3 years. The alternative lending industry they operate in is highly fragmented, with many niche players offering only a single product (auto loans, merchandise financing, credit cards, installment loans, small business lending, etc.). GoEasy sees an opportunity to become the leading national provider of alternative lending services across the full spectrum of lending products.

The Numbers

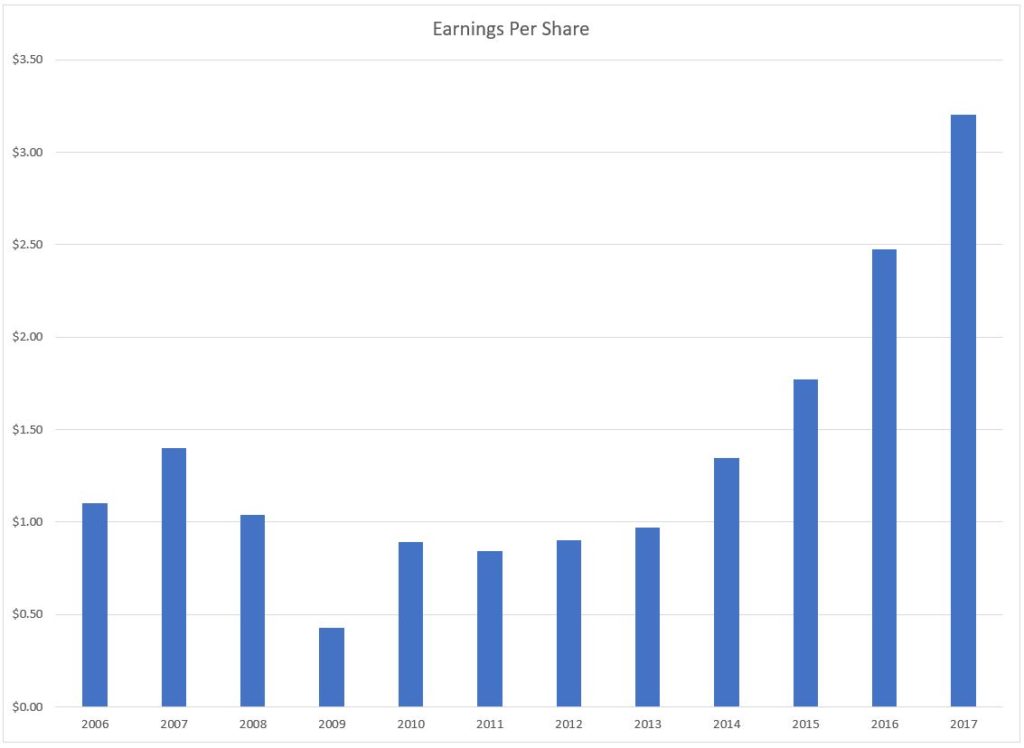

My adjusted EPS figure for GoEasy for the year just ended (2017) is $3.20. As usual, I go through the income statement and massage the reported earnings figures to eliminate many of the non-recurring elements. In GoEasy’s case, their income statement is fairly clean, without a lot of tidying up to do. There was a gain from the sale of a minority interest in a small, non-core holding that they sold which I excluded. I also excluded a charge relating to the early repayment of their existing loan facility as a result of the new 5 year lending commitment that they obtained.

At the current share price of $38.26, this would give GoEasy a p:e of 12.

Following is a chart of some of the more relevant long-term performance numbers.

(NOTE: All my earnings numbers are adjusted as I see fit to reflect what I hope is an accurate picture of ongoing, day to day operations. As well, debt levels, book value and other numbers frequently involve some interpretation on my part. I cannot vouch for the accuracy of these numbers. It is easy to enter a plus instead of a minus on my calculator or mistakenly reference the wrong line on a balance sheet. So please use these numbers as illustrative only and do your own due diligence.)

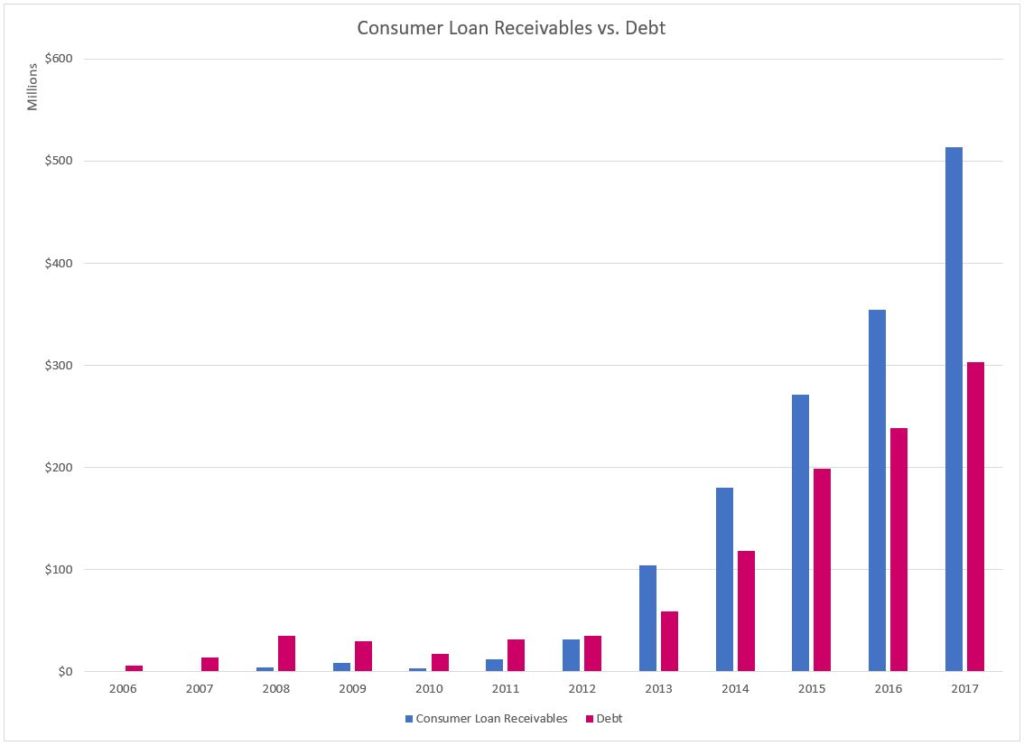

In 2011, the company started making a concerted push to grow the alternative financing side of its business as we can see from the growth in the “consumer loan receivable” item on its balance sheet. It has funded these loans with a variety of debt instruments over the years, but the overall level of debt has remained consistent with the size of its loan book which is a reassuring sign.

Being a financing company, my normal rule of thumb that total debt should be less than 3 times annual earnings does not apply here. Instead, I think it is more important to keep an eye on the ratio between the amount of money the company has borrowed (debt) and the amount it has lent out (consumer loan receivables) and so far, the value of its loan assets have exceeded its debt liabilities by a comfortable margin.

Another sign that it is managing its debt prudently is the success it has had in 2017 in securing additional funding at reasonable rates. As well, the percentage of its loan book that it is required to charge-off every year because of non-repayment has been declining. It dropped from 15.4% in 2016 to 13.6% in 2017 and the company thinks this measure will continue to improve as it starts to move more into the prime lending space.

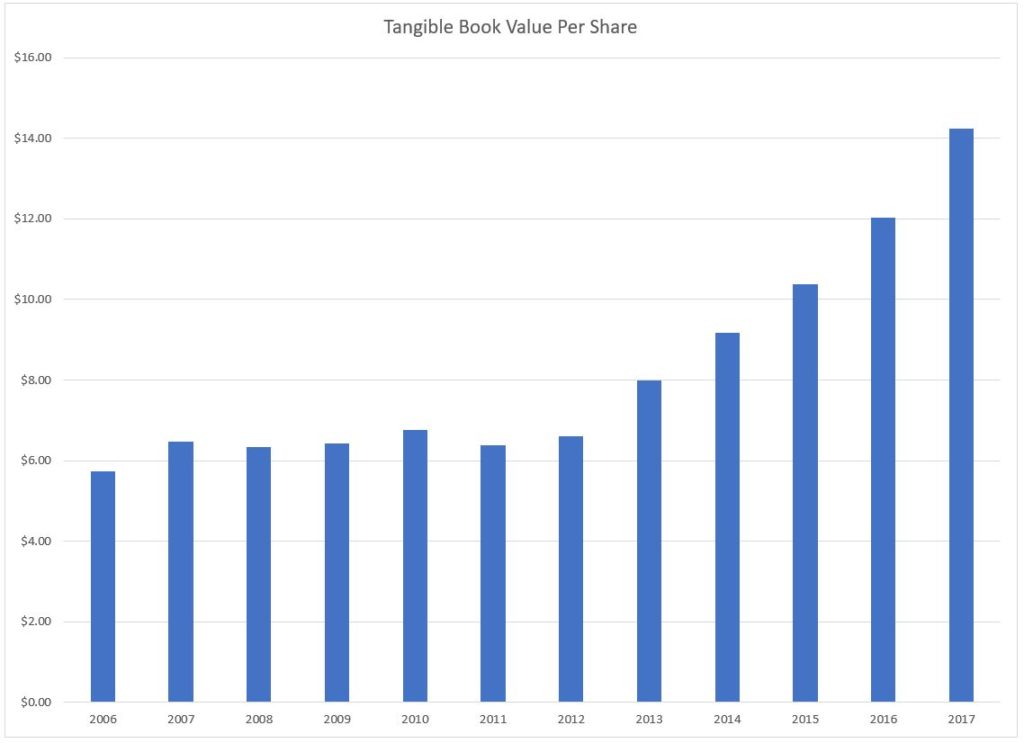

Overall, total assets have been growing more than the company’s liabilities, as demonstrated by the growth in tangible book value.

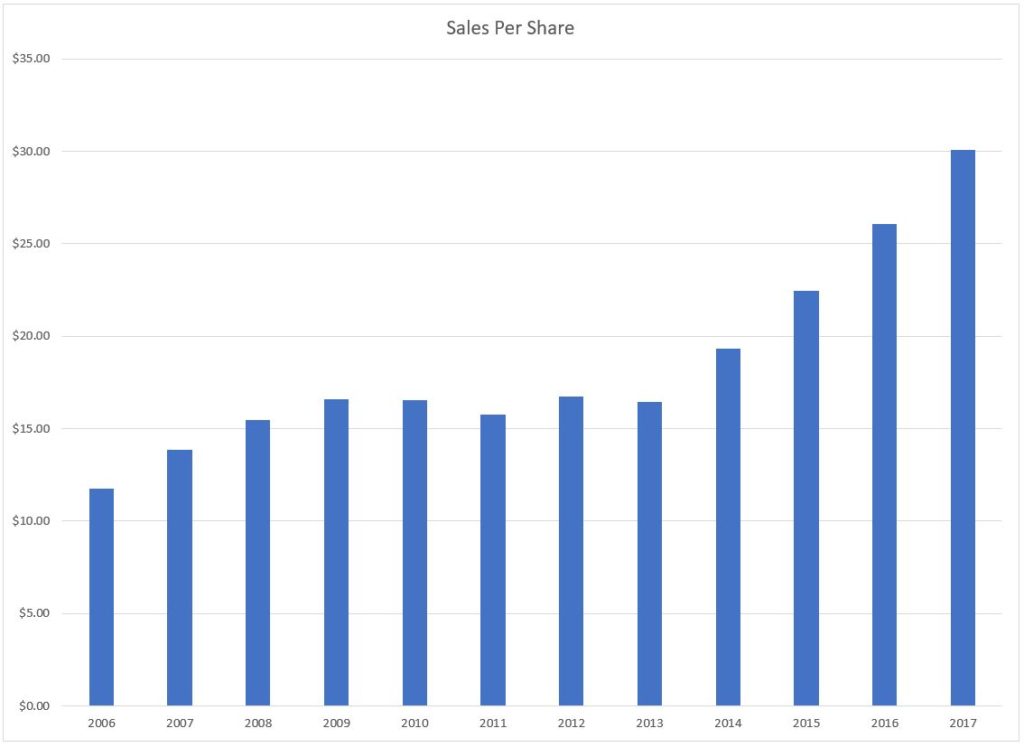

Sales have grown significantly as the company has pivoted from its rent-to-own business into the new consumer lending business.

And earnings have followed suit.

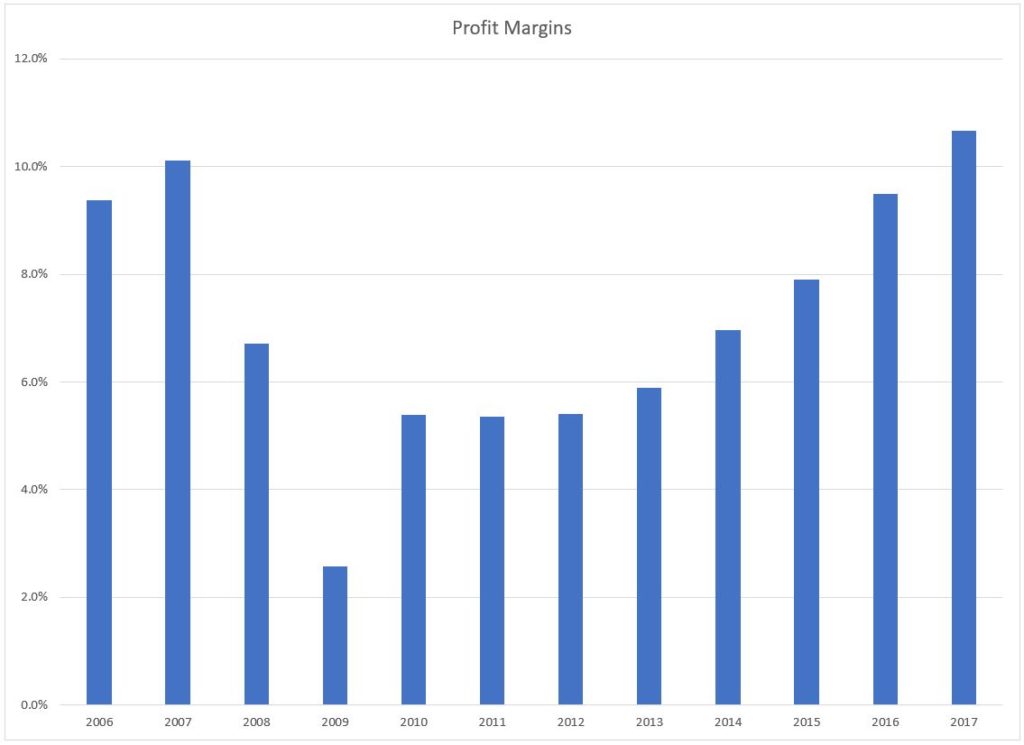

Through economies of scale and a maturation of its older easy financial outlets (they tend to get more profitable as time goes by and they build their local customer base), they have seen a steady rise in profit margins over the past 5 years.

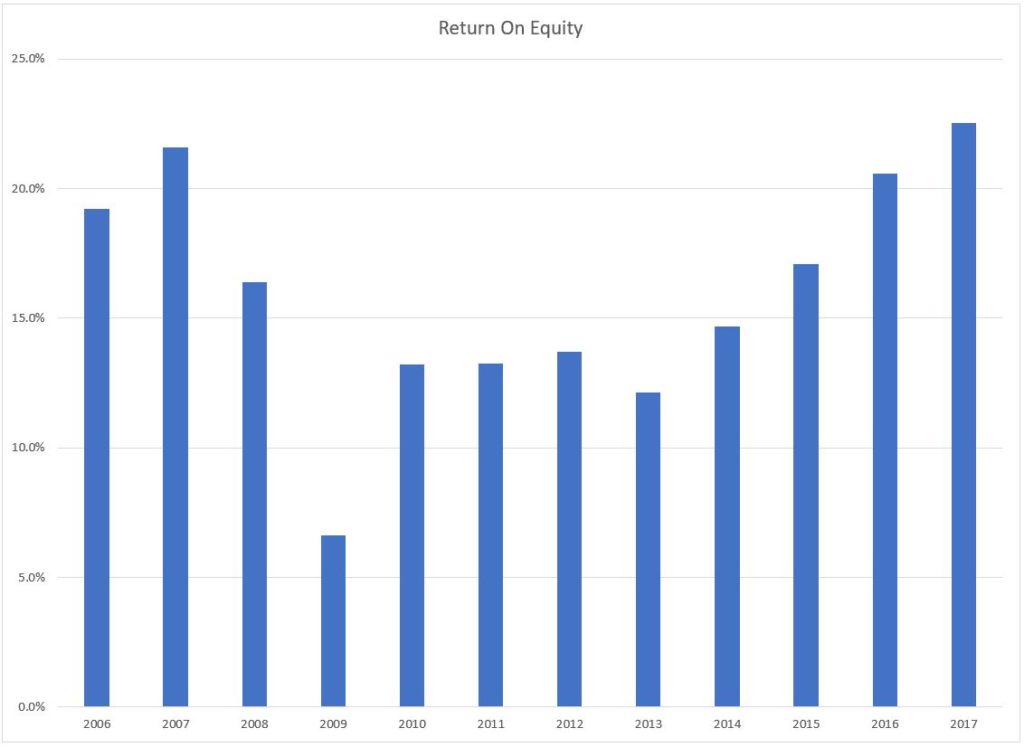

Return on equity has also been very strong, averaging over 20% in recent years.

The company has been a reliable dividend payer over the years and with the recent year end results, they announced that they were increasing their annual dividend to 90 c for a current yield of 2.3%.

Valuation

At the current $38.26 share price, GoEasy is trading at a p:e of 12. In a normal market environment, that would be a fair price to pay for an average, small cap company. However, we are not in a normal market environment right now. Prices are high across the board and the typical Canadian small cap stock is trading closer to a p:e of 16 than 12.

By this simple measure, then, GoEasy stock looks potentially attractive. For a financing company, their balance sheet looks strong and conservatively managed. They have secured financing to support their current level of operations for the next 5 years and have some extra cash set aside as well as an additional credit facility that they can draw on to fund further expansion. Their tangible book value has been growing steadily and the stock trades at a not too unreasonable p:b of 2.7.

However, the case for this stock gets much more compelling when we consider the continued growth potential.

GoEasy has undergone a complete transformation of its business over the past 5 years. It has transitioned from a somewhat uninspiring rent-to-own operator into a rapidly growing alternative finance lender with lofty ambitions and a clear pathway for continued growth.

Over the past 5 years, the company has put up some impressive numbers.

Sales have grown by 12.4% per year, adjusted earnings by 28.7% and book value by 16.6%.

In the most recent year this pace of growth has showed no signs of abating with sales growing by 15.3% year over year, adjusted earnings by 29.4% and book value by 18.2%.

But the past is not necessarily prologue. Our real question is what kind of growth can we expect going forward and is it enough to tip this company over from being a “perfectly average” sort of company into being a “high flyer”? (See the post, Building A Valuation Framework, for an explanation of these terms.)

Certainly, management’s projections are for continued rapid expansion. They are targeting a doubling of their loan book from $500 million to $1 billion over the next 3 years. They are striving to maintain their return on equity at the 20% or above mark, which, all other things being equal, could reasonably be expected to translate into a similar pace of earnings growth. They are also targeting sales growth in line with what they have achieved over the past 5 years. They see a still under-served market and the opportunity to grow their position within the industry. They will continue to expand their retail presence and continue to innovate with new product lines and new technologies as opportunities present themselves.

In my books, to qualify as a high growth, “high flyer” type of company worthy of a premium valuation, I have to be able to see the potential for the company to double in size over the next 3 or 4 years. I think GoEasy fits that description.

In the current overheated market I would expect a rapidly growing company like this to be selling at 24 times earnings. We can buy GoEasy for half this amount and in my books that offers an excellent opportunity.

What Could Go Right?

- The company meets its growth projections or even exceeds them over the next 3 years.

- In 2016, they were contemplating a major acquisition. This ultimately fell through but there is always the prospect that another attractive opportunity could present itself. With over $100 million in cash sitting on their balance sheet, they have the firepower to do some interesting transactions.

- They continue to develop their online and mobile offerings, which could offer rapid expansion without the need for any additional physical infrastructure.

- They successfully deploy new lending products and target new niches such as the recent foray into secured loan products.

What Could Go Wrong?

- The sub prime lending space gets a bad rap. Additional legislation targeting high interest lending operators could be introduced which could affect their business.

- They have a limited operating history and have been expanding very quickly. Their model is largely untested in more dour financial conditions. There is no telling what effect the next recession might have on their profitability. It might not be pretty.

- The company may expand too quickly and loosen its lending standards.

- They might have difficulty obtaining the financing they need to fund their lending at reasonable rates.

- Larger competitors could notice the success they have been having and start moving back into the sector.

Final Conclusion

GoEasy is an exciting company, with a very attractive valuation, in the field of fintech and alternative finance. They have been growing like wildfire, but from what I can tell, have been doing so in a prudent and disciplined manner. There look to be multiple avenues for continued expansion, leading me to label this a high growth stock worthy of a premium valuation. Even were the hoped-for growth not to materialize, the company would still appear to be moderately under-priced. Given its strong potential for continued growth, the stock looks to me to be significantly undervalued at the current level.

I and members of my family own shares in this stock.